Why should you invest in infill development?

The Opportunity

The Portland housing market is experiencing a surge, and infill development is at its forefront. Don't miss out on this chance to capitalize on a compelling investment opportunity. Savvy developers who weathered the storm of rising interest rates are now poised for growth. The recent dip in rates, coupled with Portland's ongoing population influx, has reignited demand for housing, especially in desirable neighborhoods where supply is constrained. But it's not just about market dynamics; it's about seizing a strategic advantage. Portland's Residential Infill Project (RIP) has reshaped the development landscape, allowing for increased density in prime locations previously zoned exclusively for single-family homes. This presents an extraordinary opportunity to acquire and develop properties with significant upside potential. We primarily focus on building fourplexes nestled within established communities, generating strong rental income in areas where demand consistently outstrips supply. While many shy away from Portland's notoriously rigorous permitting process, we benefit from this high barrier of entry. Our expertise in land use, zoning, and the city’s process affords us the unique ability to permit new projects quickly and see opportunities others do not. This is your chance to capitalize on a unique moment in Portland's real estate market. Infill development offers not just attractive returns, but also the opportunity to contribute to the city's evolving urban fabric.

Why is Now the Right Time?

Infill development in Portland presents a compelling opportunity for investors seeking strong and secure returns.

A resilient housing market, fueled by continuous population growth has created sustained demand for housing in Portland's most desirable neighborhoods. This, combined with the city's recent changes in zoning programs, makes now the ideal time to capitalize on this unique investment landscape.

Housing Production Not Meeting Need

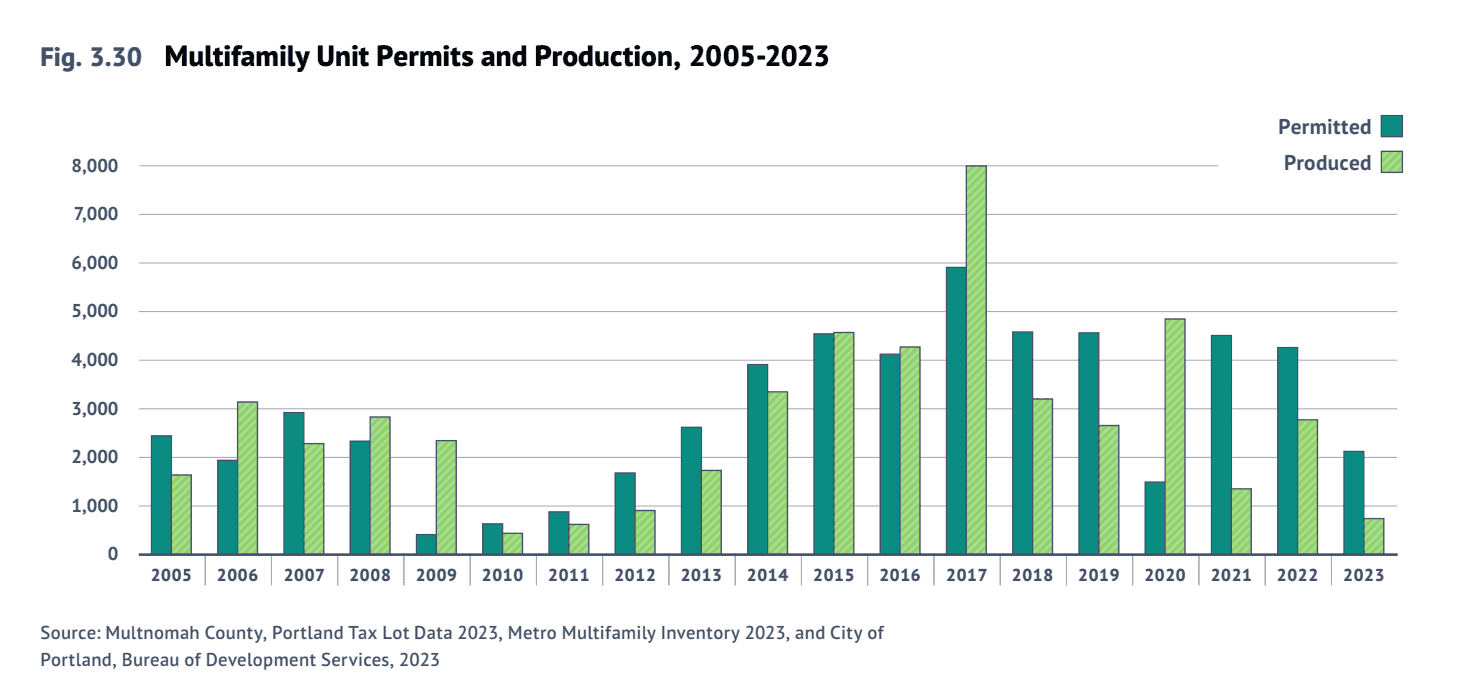

Decreasing multifamily permitting and production in 2023/2024 due to higher cost of capital creates an opportunity to meet the unmet demand for more new units.

From 2005-2023, 55,879 multifamily permits were issued, with an average of 2,941 per year. The number of permits issued peaked in 2017 at 5,910 and has since averaged 3,588 per year.

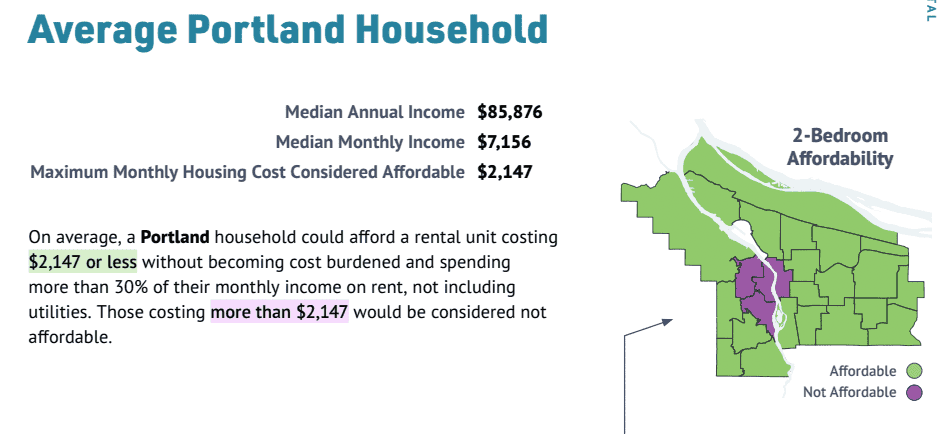

High Demand for Affordable Two Bedroom Units

There is strong demand for two bedroom units at an affordable threshold of $2,147/month.

This presents an excellent opportunity to design and build units that meet this affordability mark.

As of October 2024, Jasmine Capital has developed and owns 21 two bedroom units that rent for $2,100 and less. This price point and size is a sweet spot for our investment strategy.

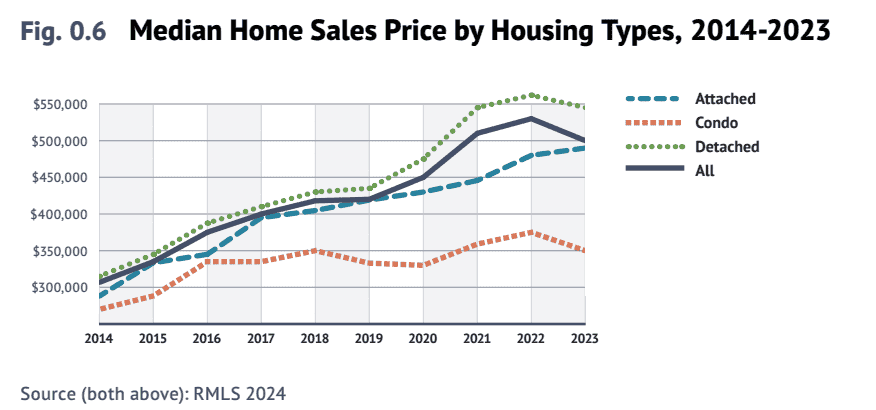

Our Shift Towards Attached/Detached Homes

In the past two years, Jasmine Capital has shifted towards primarily developing attached and detached homes as opposed to condo units. As the cost to borrow has increased, the value of condos in Portland has stagnated and decreased.

Even though we build all of our properties to keep as long-term rentals, we wish to develop the most valuable asset type to create further margins of safety for our investors.

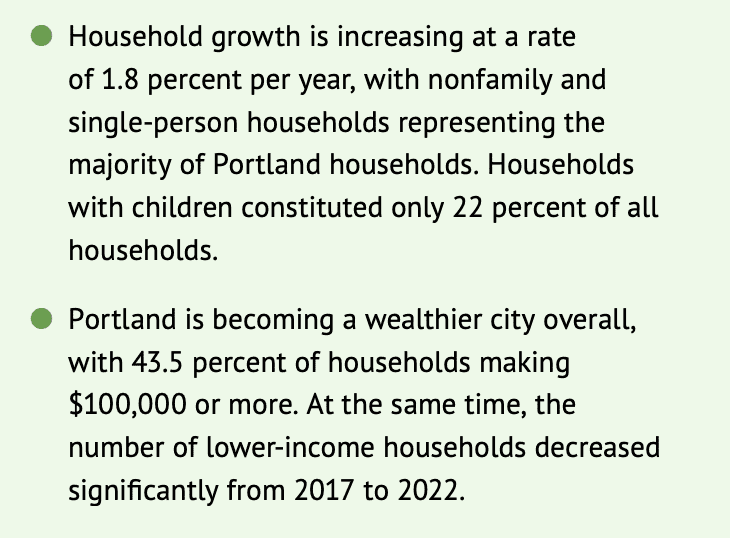

Portland is Becoming More Affluent

As Portland becomes a more affluent city, renters will continue to gravitate towards higher quality rentals. We build our rentals with high end finishes to attract the best tenants that tend to stay longer.

Where We Invest

We Invest in Walkable, A+ Locations

We invest in the best Portland neighborhoods that attract excellent tenants and command the highest rents.

These locations are characterized by being extremely walkable, and full of restaurants, markets, cafes and stores. 90% of our tenants are in their twenties and thirties, and we believe that the combination of a great location and high quality finishes is a winning strategy.

What Makes a Great Location?

Highly Rated Schools

Plentiful Markets & Restaurants

Walk/Bike Scores of 90+

Cafes & Shopping Nearby

Quick Access to Downtown

Close to Parks

Plenty of Parking

High Rents

Scarcity of Rentals

Why Inner Portland

Benefits of Investing in Walkable Neighborhoods

1.

Lack of Institutional Competition

With years of hands-on experience in [Your Industry], I bring a wealth of knowledge and expertise to every project.

2.

User-Centric

My design philosophy revolves around understanding users' needs, ensuring that every project is tailored for an exceptional user experience.

3.

Innovative

I thrive on challenges, constantly seeking innovative solutions that set your project apart in a crowded digital landscape.

4.

Design

Meticulous attention to detail is at the core of my design process, ensuring a polished and flawless end product.

5.

Partnership

I value open communication and collaboration. Your insights are crucial, and together, we'll shape a design that exceeds expectations.

Why Inner Portland

Benefits of Investing in Walkable Neighborhoods

1.

Lack of Institutional Competition

With years of hands-on experience in [Your Industry], I bring a wealth of knowledge and expertise to every project.

2.

User-Centric

My design philosophy revolves around understanding users' needs, ensuring that every project is tailored for an exceptional user experience.

3.

Innovative

I thrive on challenges, constantly seeking innovative solutions that set your project apart in a crowded digital landscape.

4.

Design

Meticulous attention to detail is at the core of my design process, ensuring a polished and flawless end product.

5.

Partnership

I value open communication and collaboration. Your insights are crucial, and together, we'll shape a design that exceeds expectations.

Why is this such a good time to invest in shopping centers?

All the factors are lined up to make the retail sector a place for investors looking to create a steady flow of passive income.

A maturing eCommerce market, brands who have proven they can stand the test of time, and a flurry of distressed investment opportunities set to hit the market over the next three or four years are only a few of the reasons the retail sector has so much upside.

You can reach out to us and discuss this opportunity to build generational wealth with our President, Andy Weiner.